Article

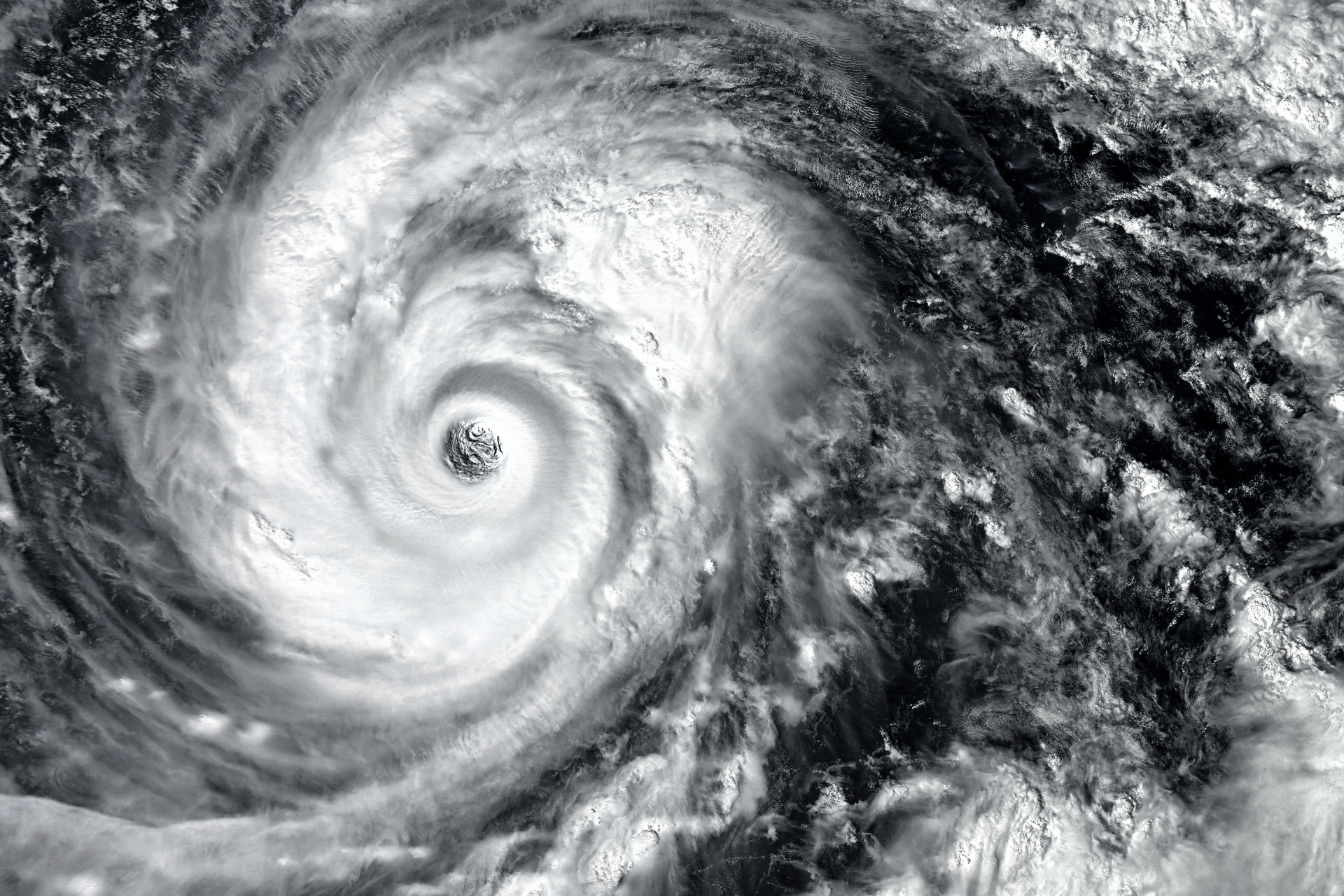

How Much Time Do I Have to File a Property Claim After a Storm in Florida?

October 7, 2024

If you've experienced property damage in Florida, you might be wondering how long you have to file a claim with your insurance company. It's essential to understand the time frame to ensure that you're protecting your rights and receiving the coverage you're entitled to.

Florida's Deadline for Filing Property Claims

In Florida, policyholders have up to two years from the date of a property loss to file a claim with their insurance company. This time limit was established under the state’s insurance laws to give homeowners a reasonable period to report damages while ensuring claims are processed promptly.

This two-year window applies to most property claims, including damage from hurricanes, storms, fires, and other covered events. However, it's critical to check the specific language in your insurance policy, as it may contain additional details or requirements.

Why Timely Filing is Important

Filing your property claim as soon as possible is crucial for a few reasons:

- Evidence Preservation: The sooner you report the damage, the easier it is to document and assess the full extent of your loss. Delays could lead to disputes over the cause or severity of the damage.

- Claim Processing: Filing early can help your claim be processed more quickly, allowing you to get back on your feet sooner.

- Avoid Denial: Waiting too long to file your claim could result in your claim being denied, leaving you to cover repair or replacement costs on your own.

How to File a Claim

If you’ve experienced a property loss, follow these steps to file your claim:

- Document the Damage: Take photos and videos of all affected areas and belongings. Keep receipts for repairs or temporary fixes.

- Review Your Policy: Check your insurance policy to understand what’s covered and if there are any specific reporting requirements.

- Contact Your Insurance Company: Notify Damasca Insurance as soon as possible to begin the claims process. Provide all relevant information and documentation to expedite the review.

- Follow Up: Stay in touch with your insurance company to ensure everything is moving forward smoothly.

Need Help with Your Property Claim?

At Damasca Insurance, we're here to assist you every step of the way. If you're unsure about the claims process or need help filing your claim, don’t hesitate to reach out. Our team is ready to help you get the support you need. Contact us today for assistance!

share this

Related Articles

Related Articles

In areas prone to severe weather, especially along coastlines, property owners often hear about three types of percentage deductibles: Hurricane, Named Storm, and Windstorm and Hail Percentage Deductibles. While all three terms might seem interchangeable at first glance, they are distinctly different and can significantly impact how much an insured person pays out of pocket following a damaging storm. At Damasca Insurance, we believe it’s important for our clients to understand these differences when purchasing or reviewing their property coverage. What Is a Percentage Deductible? Unlike traditional deductibles, which are typically a flat, set dollar amount, percentage deductibles are based on a percentage of the insured value of your property. For example, if your property is insured for $1,000,000 and your deductible is 5%, you would be responsible for the first $50,000 of any loss. However, the type of d eductible that applies depends on the specific event that caused the damage—this is where the distinction between hurricane, named storm, and windstorm and hail deductibles comes into play. Hurricane Percentage Deductibles A hurricane deductible applies only when covered property is damaged as a result of a hurricane as defined in the policy. Damage from any non-hurricane occurrence would, therefore, be subject to the lower flat deductible of the policy. While the language used by insurance companies will vary, there are four critical things contained in most hurricane deductible forms that Florida commercial property owners should keep in mind: Companies usually define a hurricane as a storm system that has been declared to be a hurricane by the National Hurricane Center (NHC) of the National Weather Service. Damage from a storm system not declared to be a hurricane by the NHC would, therefore, not be subject to the hurricane percentage deductible. The hurricane occurrence begins at the time that a hurricane watch or warning is issued for any part of Florida. A hurricane occurrence typically ends 72 hours after the last hurricane watch or warning has been issued for any part of Florida. In other words, if a hurricane is downgraded to a tropical storm before it damages your property, the loss will still be subject to the hurricane percentage deductible. Damage from a hurricane occurrence typically isn’t limited to wind damage by the deductible form. For instance, lightning and hail damage associated with the hurricane may also be subject to the percentage deductible. Additionally, damage that occurs as a result of hurricane damage, such as subsequent interior water damage due to a missing roof, would also be subject to the hurricane percentage deductible. The key takeaway with a hurricane percentage deductible is that it only applies to damages caused by hurricanes and nothing else. This means that if your structure is damaged by another type of weather event, the percentage deductible will not apply. Named Storm Deductibles Named Storm Deductible Forms are non-standard and can therefore vary greatly in language. Generally speaking, however, these percentage deductibles are typically activated under similar rules as hurricane deductibles. A named storm is usually defined as a storm system that has been given a name (not just a number) by the NHC. Any damage sustained from a named storm is subject to the percentage deductible; damage from any other covered peril would be subject to the flat deductible. And like the hurricane deductible, this can extend to damage occurring even after the storm has been downgraded and left Florida. Windstorm and Hail Percentage Deductibles On the other hand, a windstorm and hail deductible applies to damage caused by any windstorm or hail occurrence. The broader scope of the windstorm and hail deductible means that a percentage deductible can be triggered more often than a hurricane deductible. For example, wind damage to the roof of a property could lead to the activation of this deductible, even if the damage was not the result of a hurricane or tropical storm. However, unlike the hurricane or named storm deductible, most windstorm and hail percentage deductibles will only apply to two types of damage: windstorm and hail (and subsequent loss resulting from the windstorm or hail damage). Other damage, such as from a lightning strike that’s part of the same storm system, would be subject to the flat deductible. Choosing the Right Deductible Understanding the differences between these three deductibles can help you make the right decision for your organization’s insurance policy. In Florida, hurricane deductibles are generally applied only to residential properties, such as homes and parsonages, as required by the state. For commercial properties, it is more common to see windstorm and hail deductibles offered by admitted insurance companies. While some non-admitted companies may provide named storm deductibles, the standard windstorm and hail deductible remains the most frequently used for commercial structures. At Damasca Insurance, we recommend discussing your specific risk factors with an insurance professional to determine which deductible structure best suits your needs. We are here to help ensure your property is protected from whatever nature throws your way. Contact us today to review your policy and explore your coverage options! Disclaimer: Coverage forms and deductible structures may vary by insurance company and policy; it's essential to review your specific policy details to understand the terms and conditions that apply.

In the heart of every community, churches stand as beacons of hope, places for congregation, and sanctuaries of peace. But when these revered institutions undergo construction, whether for expansion, renovation, or remodeling, they face unique risks not covered by standard commercial property policies. This is where Builders Risk Insurance becomes essential. Damasca Insurance is committed to guiding churches and non-profit organizations through the complexities of managing these risks effectively. Understanding Builders Risk Insurance Builders Risk Insurance is specifically designed to protect buildings under construction or renovation. It covers a wide range of risks including fire, wind, theft, and vandalism that traditional commercial property insurance does not. For churches embarking on construction projects, this insurance is not just an option; it's a necessity. Why Standard Commercial Policies Fall Short Commercial property policies are tailored to buildings in use, not those under construction. They assume a static risk environment, not considering the dynamic and often unpredictable nature of construction sites. These policies may not cover tools, construction materials, or damages arising from construction activities. Builders Risk Insurance fills these gaps, ensuring that churches are protected throughout the construction process. The Risks of Construction and Remodeling Material Damage: Construction sites house vast amounts of materials which can be damaged by weather, fire, or vandalism. Theft: Construction sites are often targeted for theft, including tools, materials, and equipment. Liability: Construction activities can increase the risk of accidents and injuries on site, posing significant liability risks. Delays: Unforeseen events like extreme weather can delay construction, leading to financial losses. Benefits of Builders Risk Insurance for Churches Comprehensive Coverage: From the foundation being laid to the installation of the final window pane, your project is protected. Financial Protection: It provides financial backup to complete your project in case of unforeseen losses. Customizable Policies: Tailored to fit the unique needs of your church's project, ensuring you only pay for the coverage you need. Peace of Mind: Knowing your project and investment are protected allows you to focus on what matters most - serving your community. Selecting the Right Coverage Choosing the right Builders Risk Insurance requires understanding your project's specific needs. Factors to consider include: Project Size and Scope: Larger projects might need more extensive coverage. Location: Projects in areas prone to natural disasters may require additional protections. Duration: Ensure the policy covers the entire duration of the project, including potential delays. Valuation: Make sure the policy covers the full value of the project upon completion. Damasca Insurance: Your Partner in Protection At Damasca Insurance, we specialize in helping churches and non-profits navigate the complexities of Builders Risk Insurance. Our team of experts is dedicated to finding the right coverage for your project, ensuring your peace of mind from start to finish. As your church or non-profit organization embarks on construction or remodeling projects, it's crucial to understand the limitations of standard commercial property policies. Builders Risk Insurance provides the specialized coverage needed to protect your investment against the myriad of risks construction sites present. Let Damasca Insurance guide you in securing the right protection for your project, ensuring that your place of worship remains a beacon of hope for years to come. For more information on Builders Risk Insurance and how it can safeguard your construction project, contact Damasca Insurance today. Together, we'll build a foundation of protection for your church's future.

In managing your church's finances, every dollar counts, and insurance premiums are no exception. Understanding how to lower these premiums can make a significant difference in your church's budget, allowing you to allocate more resources to your ministry and community efforts. Here are some effective strategies your church can adopt to help reduce insurance costs without compromising coverage. Firstly, prioritize risk management. Implementing robust safety measures can not only prevent accidents but also make your church a lower risk in the eyes of insurers. Regularly inspect and maintain church property, from checking electrical systems to ensuring walkways are clear and well-lit. A well-documented safety protocol for activities and events can also show insurers that your church takes risk mitigation seriously. Secondly, consider bundling policies. Just like bundling home and auto insurance can lead to savings, combining different insurance policies your church needs under one provider can often lead to discounted rates. It's also a good idea to regularly review and update your insurance coverage. Make sure it aligns with your current needs and that you're not paying for unnecessary coverage. Lastly, foster a strong relationship with your insurance provider. Keeping an open line of communication can lead to personalized advice on reducing risks and may even lead to premium discounts based on your church's specific situation and history. By taking proactive steps in risk management, policy review, and insurer communication, your church can effectively navigate insurance costs, ensuring that more of your funds go towards your mission and less towards premiums. Remember, the goal is to strike a balance between adequate protection and cost-effectiveness, paving the way for a financially healthier and more impactful ministry.