Articles

Why Insurance is Essential for Churches

The Importance of Insurance for Churches Churches play a vital role in communities as places of worship, gathering, and support. However, like any other organization, churches face risks that can...

Read more

Understanding the Benefits of Insurance for Non-Profits

Insurance: A Safety Net for Non-Profits Running a non-profit organization is more than just about passion and mission-driven work; it involves a significant amount of risk management. Insurance...

Read more

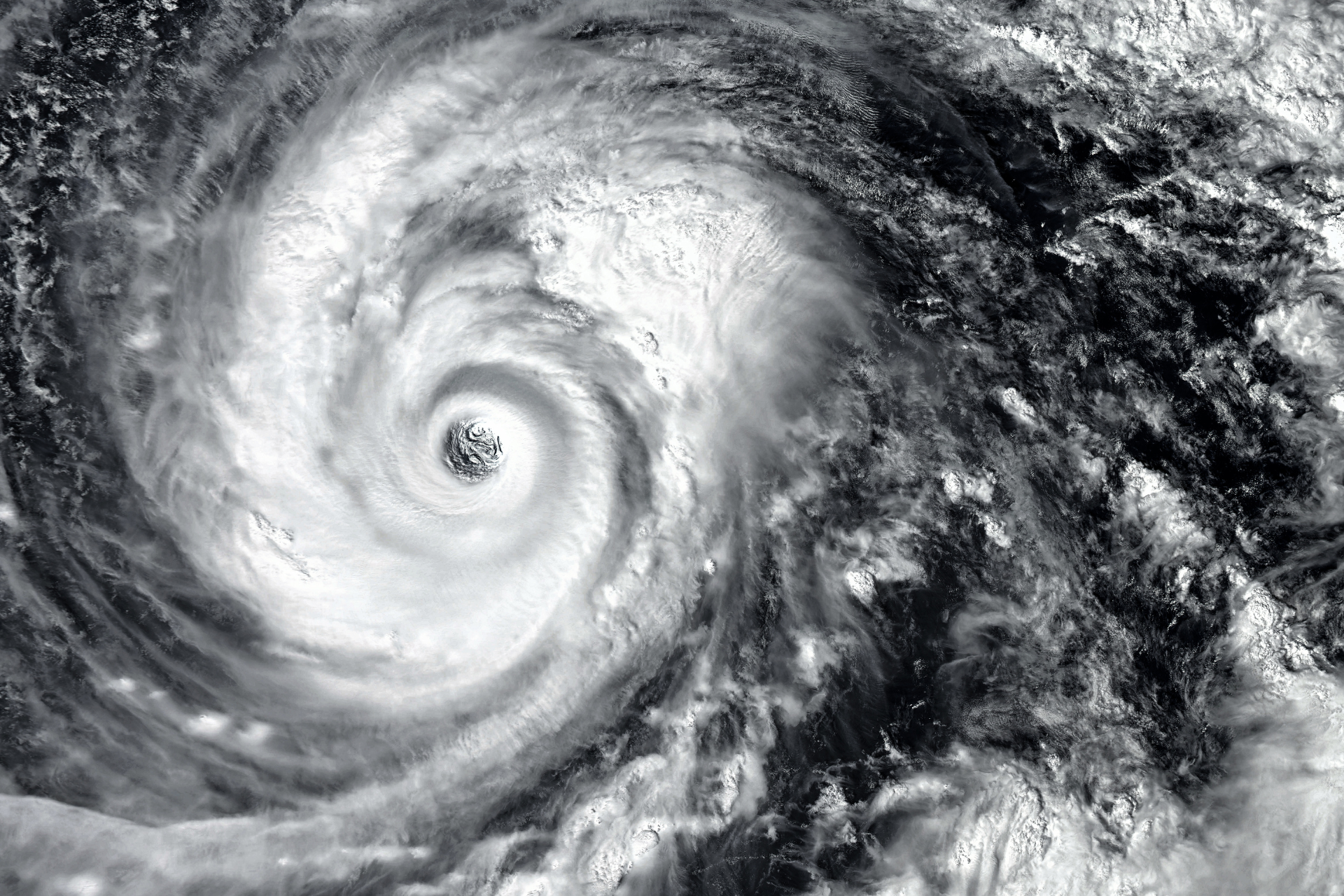

How Much Time Do I Have to File a Property Claim After a Storm in Florida?

If you've experienced property damage in Florida, you might be wondering how long you have to file a claim with your insurance company. It's essential to understand the time frame to ensure that...

Read more

Understanding Hurricane Percentage Deductibles vs. Windstorm and Hail Percentage Deductibles

In areas prone to severe weather, especially along coastlines, property owners often hear about three types of percentage deductibles: Hurricane, Named Storm, and Windstorm and Hail Percentage...

Read more

Why Churches Need Builders Risk Insurance

In the heart of every community, churches stand as beacons of hope, places for congregation, and sanctuaries of peace. But when these revered institutions undergo construction, whether for...

Read more

Navigating Costs: How Your Church Can Lower Its Insurance Premiums

In managing your church's finances, every dollar counts, and insurance premiums are no exception. Understanding how to lower these premiums can make a significant difference in your church's budget...

Read more

The Road to Protection: Understanding Hired and Non-Owned Auto Coverage for Churches

When it comes to safeguarding your church's assets and people, understanding the ins and outs of insurance is crucial, especially for areas you might not immediately consider, like vehicles. You...

Read more

Decoding Percentage Deductibles for Windstorm and Hail Losses

When it comes to insurance, especially for coverage against windstorms and hail, you might come across a term called 'percentage deductible.' But what does it really mean, and how is it different...

Read more

Understanding a Hard Market: What It Means for Your Organization

Navigating the world of insurance can sometimes feel like sailing through unpredictable seas, especially when you encounter a 'hard market.' But what exactly is a hard market, and how does it...

Read more